Unlocking the Power of Automated Pay-roll Equipments: Exactly How Innovation Transforms Payroll Monitoring to Increase Efficiency and Compliance

Benefits of Automated Pay-roll Equipments

The application of automated pay-roll systems has actually considerably improved effectiveness and precision in pay-roll management for companies of all dimensions. By automating pay-roll procedures, organizations can simplify tasks such as calculating earnings, withholding tax obligations, and creating reports. One essential benefit of automated pay-roll systems is the decrease of human error. Manual payroll processing is susceptible to blunders, which can bring about costly errors and compliance issues. Automated systems carry out computations properly every single time, ensuring that employees are paid properly and on time.

Enhanced Efficiency Via Automation

Carrying out automated pay-roll systems leads to a notable improvement of operational efficiency within companies. By automating repeated tasks such as information entrance, calculations, and conformity tracking, pay-roll procedures become structured, decreasing the likelihood of mistakes and saving beneficial time. Automated systems can deal with large quantities of data swiftly and accurately, removing the need for hand-operated intervention and lowering the danger of human mistake. This enhanced performance enables pay-roll teams to concentrate on more calculated tasks, such as analysis and decision-making, inevitably contributing to boosted overall performance (Payroll Services by CFO Account & Services).

Furthermore, automation makes it possible for real-time access to pay-roll details, facilitating faster decision-making and enhancing communication within the company. Supervisors can quickly access reports and analytics, allowing them to make enlightened choices based on up-to-date data. Furthermore, automated pay-roll systems can create various reports immediately, saving time and making sure conformity with governing requirements.

Ensuring Compliance With Laws

With the increased performance brought around by automated pay-roll systems, organizations can confidently navigate the complex landscape of governing conformity, making sure adherence to essential legislations and guidelines. Automated payroll systems play a crucial duty in assisting services stay certified with numerous guidelines, such as tax laws, wage and hour needs, and worker benefits regulations.

Furthermore, automated pay-roll systems frequently come outfitted with features that assist visit homepage businesses stay up to day with changing guidelines. On the whole, leveraging automated payroll systems is critical in streamlining compliance initiatives and mitigating risks for companies of all dimensions.

Smooth Integration With HR Equipments

Facilitating operational effectiveness, automated pay-roll systems seamlessly integrate with human resources systems to simplify organizational processes. Payroll Services by CFO Account & Services. This combination in between pay-roll and human resources systems allows for a more cohesive technique to taking care of employee data, time tracking, benefits administration, and payroll handling. By syncing these systems, information disparities are minimized, leading to enhanced accuracy in payroll computations and conformity with guidelines

In addition, smooth assimilation in between pay-roll and human resources systems makes it possible for real-time updates throughout departments. When adjustments such as promos, discontinuations, or wage changes are made in the human resources system, they instantly show in the pay-roll system. This automation minimizes hands-on data entrance, eliminates the risk of errors, and ensures that employees are made up appropriately and in a prompt way.

Furthermore, the integration of pay-roll and HR systems gives useful insights for decision-making processes. Inevitably, the seamless integration of pay-roll and Human resources systems maximizes effectiveness, boosts compliance, and encourages organizations to concentrate on their core goals.

Transforming Financial Procedures

The integration of automated pay-roll systems with human resources systems not only improves functional efficiency however additionally plays a pivotal function in changing economic operations within organizations. By simplifying payroll processes, automated systems minimize the chance of errors, guaranteeing exact economic transactions. This enhanced precision brings about improved financial reporting and much better decision-making for monitoring.

In addition, automated payroll systems provide real-time insights into labor expenses, enabling organizations to maximize their budget allocation efficiently. This transparency allows companies to determine locations where cost-saving procedures can be applied, inevitably adding to boosted economic security.

In addition, the automation of pay-roll procedures lowers the moment and sources generally invested in hands-on computations and data entry. This efficiency not only conserves prices yet additionally enables monetary teams to concentrate on even more critical jobs that include value to the organization. In significance, the makeover of economic procedures through automated payroll systems brings about raised performance, compliance, and overall financial wellness for services.

Final Thought

To conclude, automated pay-roll systems use many benefits such as increased performance, made sure compliance with laws, smooth integration with human resources systems, and improvement of financial procedures. website here By taking advantage of the power of innovation, companies can reinvent their payroll monitoring processes to enhance efficiency and guarantee conformity with legal needs. Accepting automated pay-roll systems can enhance procedures, save time and sources, and eventually drive success in today's fast-paced service environment.

The application of automated payroll systems has significantly improved efficiency and accuracy in pay-roll management for organizations of all sizes.Assisting in operational efficiency, automated payroll systems flawlessly integrate with Human resources systems to streamline organizational procedures. When changes such as promotions, discontinuations, or salary modifications are made in the Human resources system, they automatically show in the pay-roll system.The integration of automated payroll systems with HR systems not just enhances operational effectiveness however also plays a critical duty in changing financial operations within companies.In verdict, automated pay-roll systems provide many advantages such as raised efficiency, made sure conformity with laws, seamless integration with best site HR systems, and improvement of monetary operations.

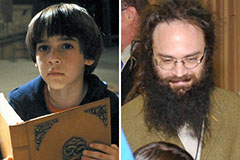

Barret Oliver Then & Now!

Barret Oliver Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now!